We use cookies in order to offer the most relevant information and deliver the best experience.

Please accept cookies for optimal performance.

Click here for more information.

The Property division was originally established to maximise the value of land that is surplus to the Building Products business in Australia. Over time, the Property division has evolved and now consists of two Joint Venture Property Trusts with Goodman Group, plus 100% owned land holdings, both operational and for potential development.

Brickworks holds a 50% interest in the Industrial JV Trust, with the remaining 50% interest held by Goodman Group.

This Industrial JV Trust has grown to become one of Australia’s leading industrial property portfolios and is exposed to long-term structural tailwinds associated with the transition to e-commerce and the digital economy. Through the long-standing (~20 years) relationship with Goodman Group, the Industrial JV Trust has developed a portfolio of prime A-grade facilities with blue-chip tenants such as Amazon, Woolworths, Coles, DHL, Telstra and Australia Post. As at 31 January 2025, the Industrial JV Trust had total assets of $5.0 billion.

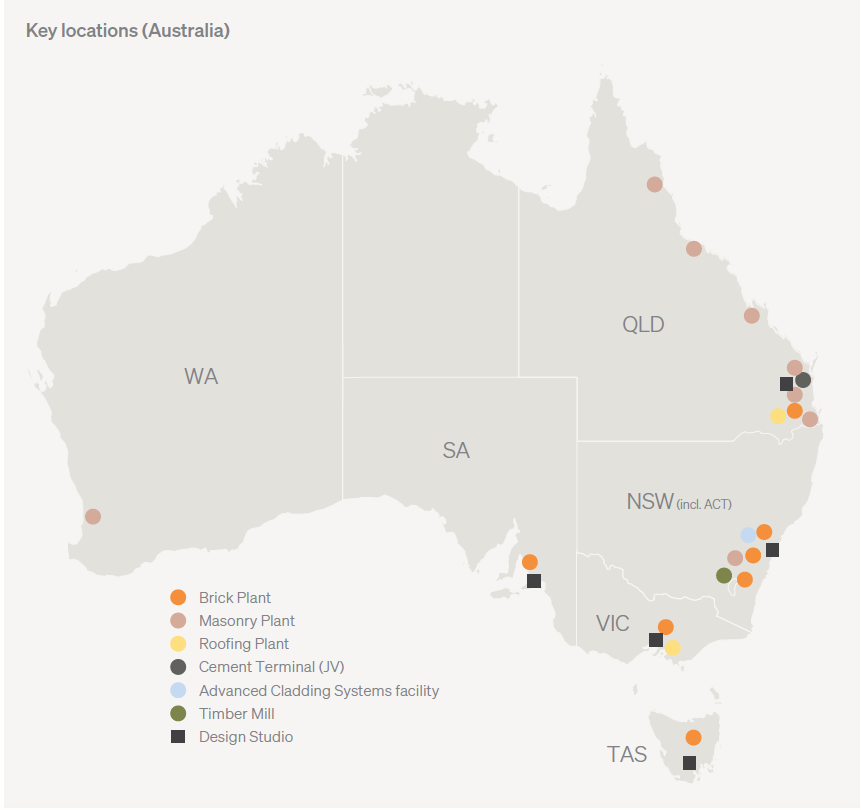

Building Products Australia is a leading manufacturer and distributor of building products across all Australian states.

Following the Bristile acquisition in 2003, Building Products Australia has grown from a two-state brick manufacturer, in New South Wales and Queensland, to a diversified national building products business.

In total, Building Products Australia comprises 19 active manufacturing sites, and a vast network of company-owned design centres, studios and resellers across the country.

The portfolio includes key brands such as Austral Bricks (Australia’s largest clay brick manufacturer), Austral Masonry and Bristile Roofing. The portfolio also includes a 33% interest in the Southern Cross Cement joint venture, established to import and supply cement to the joint venture partners in Queensland.

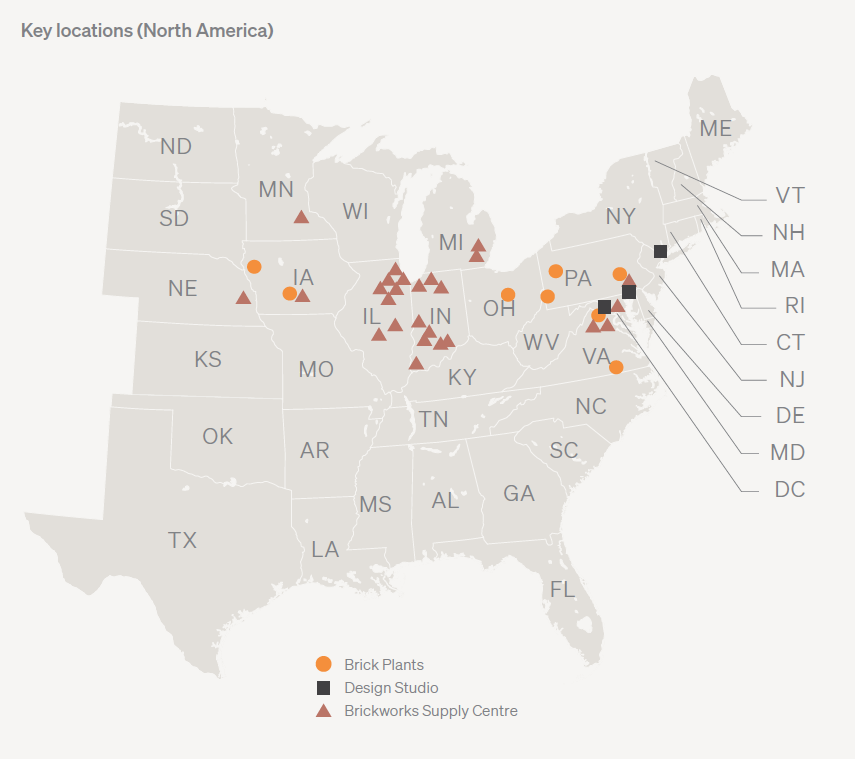

Brickworks North America has a leading position in the Midwest, Northeast and Mid-Atlantic states, and has a strong focus on architectural and premium products.

It has eight currently operating brick manufacturing sites, complemented by company-operated distribution outlets, design studios (New York, Philadelphia and Baltimore) and an extensive reseller network.

Brickworks has a Code of Conduct under which all Directors, senior management and employees are expected to operate. This Code is centred on having Brickworks and its employees achieve the highest level of integrity in all its business dealings at all levels of the organisation.

Brickworks is committed to conducting business in accordance with high ethical standards, integrity and accountability.

We have adopted a policy prohibiting bribery and corruption of public officials, making political donations, secret commissions, making or receiving facilitation payments and kickbacks.

Consistent with our commitment to act fairly, with honesty and integrity Brickworks has a Whistleblower Policy and has implemented Behonest@Brickworks an anonymous whistleblower service delivered by Deloittte.

Brickworks is committed to respecting and supporting the dignity, well-being and human rights of employees and the supply chain, working collaboratively with our partners and suppliers to ensure business is conducted in an honest and ethical manner. This includes identifying and addressing modern slavery and human rights risks throughout our business and supply chain.

We use cookies in order to offer the most relevant information and deliver the best experience.

Please accept cookies for optimal performance.

Click here for more information.